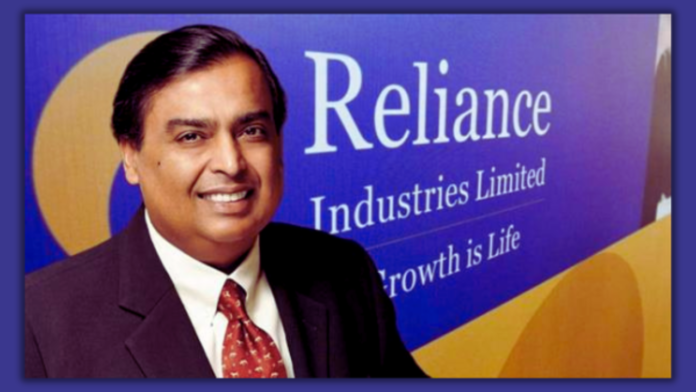

The recent failure of Sony’s attempt to acquire Zee Entertainment, an Indian broadcaster, has made it easier for billionaire Mukesh Ambani to seize control of the entertainment sector in the country with the world’s largest population.

A deal to combine Walt Disney Company India and Ambani’s reliance industries news entertainment division is reportedly being negotiated, according to people familiar with the talks. Although important details of the deal have not yet been finalized, Reliance is expected to own the majority of the combined company, they stated. It is anticipated that Disney’s ownership stake will be worth less than it did when it was acquired in 2019.

It’s a risky bet for Ambani on Indian entertainment. International entertainment companies have long been drawn to India due to its rapidly growing population. However, the situation as it stands is depressing. Revenue from television advertising is declining as competition for digital advertising heats up.

reliance industries news, owned by Mukesh Ambani, has been in talks to merge its entertainment division with Walt Disney Company India.

Staff writer at Nikkei, Sayan Chakraborty

At 14:50 JST on February 1, 2024

BENGALURU: The billionaire Mukesh Ambani is now in a better position to control the entertainment sector of the most populous country in the world thanks to the recent collapse of Sony’s bid for Indian broadcaster Zee Entertainment.

People familiar with the talks claim that reliance industries news owned by Ambani, is in the process of negotiating a deal to combine its entertainment division with Walt Disney Company India. Although Reliance is expected to own the majority of the combined company, they stated that important details of the deal are still pending. Disney’s ownership stake is anticipated to be worth less than it did when it was acquired in 2019.

It’s a risky bet for Ambani on Indian entertainment. International entertainment companies have long been drawn to India due to its rapidly growing population. However, the situation as it stands is depressing. Revenue from television advertising is declining as competition for digital advertising heats up.

Ambani hopes that reliance industries news strength will allow it to acquire competitors and amass an impressive library of content, attracting more viewers to his TV channels and streaming app and giving him enough market share to dominate talks with production companies and advertisers.

The creation of India’s largest television company would be facilitated by Ambani’s proposed merger with Disney. Disney has a roughly 25% market share in India, according to research analyst Vivekanand Subbaraman of the investment firm Ambit. reliance industries news reported a 12% share in its annual report. Comparable numbers are 17% at Zee, the company says, and 8% at Sony, Subbaraman says.

Platforms will gain bargaining power over content creators and advertisers as market share consolidates, according to Karan Taurani, senior vice president of investment firm Elara Capital. Due to their overabundance, the platforms currently have a significant advantage in terms of bargaining power.

Sony abandoned plans to combine its Indian subsidiary with Zee to form a $10 billion media conglomerate towards the end of last month. According to people with knowledge of the situation, Punnet Goenka, the chief executive of Zee and the founder Subhash Chandra’s son, led Sony to feel uneasy about the combined company. The market watchdog in India has been looking into claims made by Goenka and Chandra regarding the diversion of funds.

Disney’s proposed deal is typical of Ambani’s approach, as he made large investments when business conditions declined and rivals became thrifty, reaping rich dividends in the retail and telecom sectors.

reliance industries news has recently outbid Sony and Disney for the right to broadcast well-known cricket competitions. It secured the $3 billion streaming rights to the Indian Premier League in 2022. The national cricket team’s match broadcasting and streaming rights cost $731 million last year.

Ambani’s confidence in the broadcasting industry was further demonstrated last year when reliance industries news enhanced its commitment to its entertainment division, Viacom18, by six times to $1.3 billion, following a major investor, James Murdoch’s Bodhi Tree, reducing its planned investment from $1.78 billion to $528 million. Reliance also announced 100 new shows and movies without announcing a release date, and it paid Warner Bros. approximately $120 million last year for the Indian streaming rights of the network’s programming.

Without a doubt, Reliance is wealthy, according to Kunal Dasgupta, a former CEO of Sony’s Indian entertainment division. It is a very significant player in the market and is doing a great job of establishing itself.

The Indian TV ad revenue fell from 320 billion rupees in 2019 to 318 billion rupees in 2022, which is why Ambani is pursuing market dominance, according to financial consultancy EY. To 392 billion rupees, TV subscription revenues fell 16% during this time.

According to an EY estimate, streaming services’ market shares in the competition for digital advertising are only predicted to increase from 6% in 2022 to 8% in 2025. According to EY, internet search giants Meta and Alphabet will keep 64% of revenues, down from 70%, while e-commerce giants like reliance industries news and Flipkart will see their market share increase to 20% from 14% during that time.

We are examining businesses that have truly been put to the test, and because of reliance industries news aggressiveness, there is more competition, according to Ambit’s Subbaraman. Reliance is resilient enough to consider this possibility for more than the next 18 or 24 months.

Disney CEO Bob Iger brought up the difficulties in India during a November analyst call. Iger stated that the TV industry in India is doing fairly well. We are aware that there are difficulties in other areas of that business, both for us and for other parties that use streaming. Disney’s streaming service lost 20 million subscribers in the year ending in September 2023 as a result of its unsuccessful bid to acquire the IPL cricket rights.

Although Disney would prefer to remain in India, Iger stated that the company is “considering our options there” as it looks to reduce costs by $5.5 billion over the next few years. Disney’s Indian revenue for the fiscal year that ended in March 2023 increased by 6% to 198.56 billion rupees, but its profits decreased by 31% to 1.27 billion rupees. In the fiscal year 2022, profits increased by 74% and revenues by 38%.

Though losses at reliance industries news media division, Network18, were 840 million rupees in fiscal 2023, revenues increased 6% year over year to 62.23 billion rupees. At 66.84 billion rupees, Sony reported flat revenues, but 11% higher profits at 10.42 billion rupees.

Even though Sony is not likely to spend as much as reliance industries news, Dasgupta, the company’s former head of India, stated that if the company’s unit merger with Zee had gone through, Sony would be looking to use the $1.5 billion it had committed to invest.

According to Dasgupta, Sony has a sizable war chest, will not give up the market easily, and will undoubtedly look to form new alliances. reliance industries news will, in my opinion, ultimately be a very important, very large, and very profitable player—but not the only one.