Possibly advantageous for billionaire (gautam adani) An explosive report by U.S.-based Hidenburg Research, a group that caters to short sellers, claims that one of the biggest corporate takedowns involved fraud and dishonorable stock price manipulation. A year later, Adani Group angrily refutes these allegations, claiming that the foundations of the Indian tycoon business remain strong.

As the empire arose from its ports to become powerful, it completed historic projects, lowered debt, retracted founders’ share pledges, attracted new allies from the United States to the Middle East, and stepped up communication with lenders and investors. This benefits the increasing number of cargo containers and air travelers. Mumbai, the financial center of India, is building a new airport, and the massive Dharavi slum is being redeveloped.

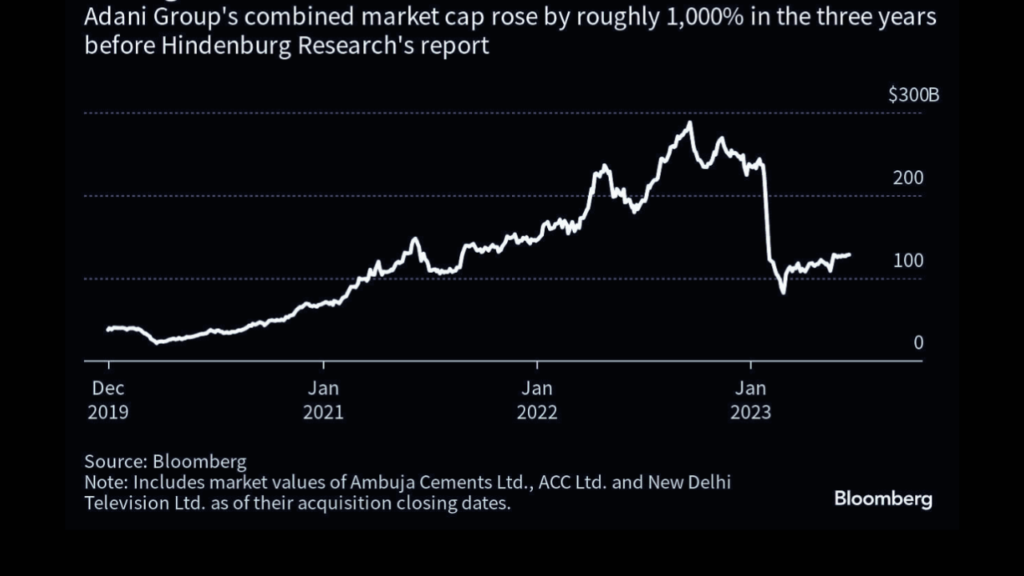

The Hidenburg report’s fallout is still being felt. Even though stock has increased significantly from the lows of the gautam adani revious year—by over $90 billion—it is still almost $60 billion below its pre-Hidenburg peak. The majority of the dollar bonds in the group have recovered their losses during this time.

Opposition political parties and other critics of Prime Minister Narendra Modi’s alleged closeness to powerful companies and their opaque networks persist. Concerns regarding the company’s accounting procedures were raised by the resignation of the port business auditors last year. The billionaire stated that his companies do not receive special treatment from the government, but gautam adani representatives have not responded to requests for comments, citing adherence to all laws and accounting regulations.

Many investors now think that the Adani empire is growing again, despite these problems. According to Chakri Lokpriya, Managing Director of RedStrobe LLP, a property management company in Chennai, institutional and retail investors are feeling more at ease as a result of the Supreme Court’s rulings rejecting special investigations, appeals from new, significant investors, and funding from American agencies. The year after the short-seller broadside, according to Lokpriya, has been advantageous for the Adani Group.

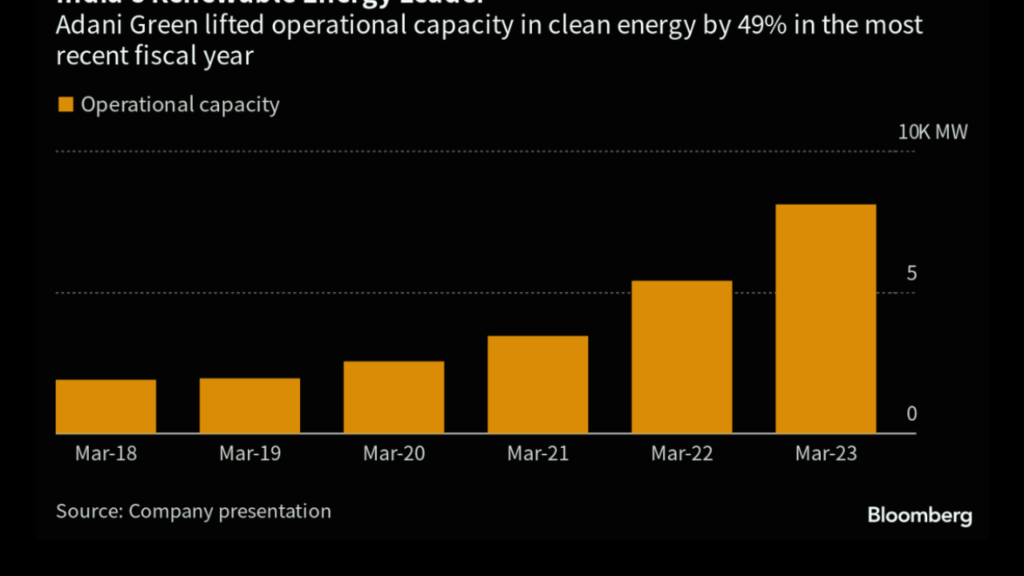

The group’s extensive foundational infrastructure, which consists of cement plants, power lines, empire ports, airports, data centers, and solar parks, accounts for most of its flexibility. As a result, gautam adani is now among India’s fastest-growing companies, luring eager investors to take advantage of this. Within the cutthroat, linear world of South Asian China-alternatives, it appears as a unique case study of global economic success.

The following business metrics for gautam adani empire have declined since the short-seller broadside on January 24, 2017

Following Hidenburg’s report, Adani’s shares fell into a deep crisis, resulting in billion-dollar losses for the market and making the founders vulnerable to margin calls on their pledged shares. gautam adani and his family substantially decreased their ownership of collateralized shares by paying $2.15 billion in advance.

A substantial amount of the nearly $5 billion in investments made by the group came from Rajiv Jain’s GICJYOTI Partners LLP, a well-known investor who worked hard to acquire stakes in four Adani companies in March and has since made additional investments.

The 10 listed Adani companies have a combined market value of about $175 billion, which is approximately 112% more than when it was $82 billion in February of last year following the release of the short-seller report. All losses incurred following the Hidenburg report have been eliminated for five of them.

The recent spike in shares can be attributed to the Indian Supreme Court’s ruling that denied the plea for a special or federal probe into Adani’s company operations. An American-backed organization has also invested $553 million in the group’s port operations in Sri Lanka.

The managing director of Churiwala Securities Private Limited in Mumbai, Alok Churiwala, said The Hidenburg report offered some hope because it gave investors who missed out on Adani’s shares at a favorable price a chance to acquire them.

Adani Group still needs to increase analyst coverage, though. For the majority of its businesses, excluding port operations and recently acquired cement producers, it is insufficient. Avoiding significant stock fluctuations would also be aided by expanding its public float.

Presentations made to exchanges revealed that in the six months leading up to September, the group’s net debt dropped by 3.5% to $21.72 billion. In September 2022, the company’s net debt-to-EBITDA ratio decreased to 2 from 3.3 in March and 3.9 in August 2022, the pre-Hindenburg period that was characterized by rapid expansion.

The 15-dollar average of gautam adani was more than $1.80 above the dollar threshold typically taken into account for distressed bonds as of January 19. Data compiled by Bloomberg shows that most shares were trading higher than they had been following the report from the previous year.

Lenders’ confidence in the group increased when it successfully refinanced a $3.5 billion loan in October.

gautam adani, who first gained notoriety as a diamond trader in Mumbai in the 1980s, has mostly weathered the short-seller crisis as he proceeds with significant infrastructure projects or business ventures in India.

This points to a possible point of contention within the group and presents Adani with political risk, akin to his ascent under Modi’s rule. This year’s Indian national elections will see Modi make a compelling case for a third term as prime minister.

One major obstacle is the local market regulator’s investigation into possible securities law violations by Adani Group. The regulator has been given three months by India’s highest court to finish its investigation by January 3.

Despite the fact that Adani Enterprises Limited had to postpone a $2.5 billion share sale as a result of the Hidenburg report, the group has acquired new, significant backers. With the goal of becoming one of the biggest investors in the Adani Group within the next five years, Jain of GICJYOTI Partners LLP has increased his ownership of four Adani companies by double in the last few months.

In the international financial hub of Abu Dhabi, the Adani family is also changing. They have established a special purpose vehicle that will house a number of wealthy people who wish to safeguard their assets.

Adani faces significant obstacles in Australia, but he manages them and carries on with business, according to Michael Kugelman, Director of the South Asia Institute at the Wilson Center in Washington.